Secure Your Home in Mallorca with the Right Insurance: The Expert Guide 2024

If you own property in Mallorca, Spain, you may wonder about the importance of building and home insurance. This comprehensive guide will provide detailed instructions on the various types of insurance available, how much they cost, and whether or not you need to purchase insurance. Additionally, we will discuss how to get discounts and calculate the insurance cost. We'll also recommend which insurance companies or banks to choose in Mallorca. By reading this article, you'll have all the information you need to make an informed decision about home insurance in Mallorca.

Content:

Is Home insurance a must-have in Majorca?

When is it recommended to have property insurance in Mallorca?

Advice on Home Insurance from a Property Broker in Mallorca

Ways to Lower the Cost of Property Insurance in Mallorca

Factors that increase the cost of property insurance

Ways to make home insurance cheaper

Real Estate Insurance Companies in Mallorca

How to Choose a Home Insurance Broker in Mallorca

Is Construction Insurance a Mandatory?

Is Home insurance a must-have in Majorca?

While home insurance is not mandatory for private homeowners in Mallorca, it is a requirement if you're purchasing a property with a mortgage loan. The Spanish bank providing the mortgage typically requires you to have home insurance in Mallorca. While you can choose any insurance company for your policy, the bank may have insurance programs offering more favourable terms than those from third-party companies. If you plan to take out a mortgage on a Mallorca property, consider the bank's insurance options.

If you plan to take out a mortgage on a Mallorca property, it's important to note that property insurance is required. However, taking out a mortgage with home insurance in Mallorca will likely result in more favourable mortgage terms and better consideration from the bank. If you're purchasing a complex residential property such as an apartment, townhouse, house, or villa in a gated community, community housing insurance in Mallorca will be necessary.

To determine if property insurance is mandatory for your property, consult your Mallorca real estate agent for guidance.

When is it recommended to have property insurance in Mallorca?

If you're purchasing a property with a mortgage, it's worth considering buying additional home insurance in Mallorca. This can make your mortgage loan more affordable. After the first year of mortgage payments, you can opt out of property insurance in Mallorca. In a loss event, having property insurance ensures the owner will have a home with an outstanding mortgage.

Home insurance is a wise investment when the value of your property is significant to you. Different home insurance schemes in Mallorca allow you to insure your building and household. However, we recommend insuring antiques and valuable art items separately.

Supplementary insurance for properties in Mallorca located in public complexes or blocks of flats is also advisable. The compulsory insurance for this type of property only covers the minimum value of the building. Supplementary insurance ensures that you will be compensated in full.

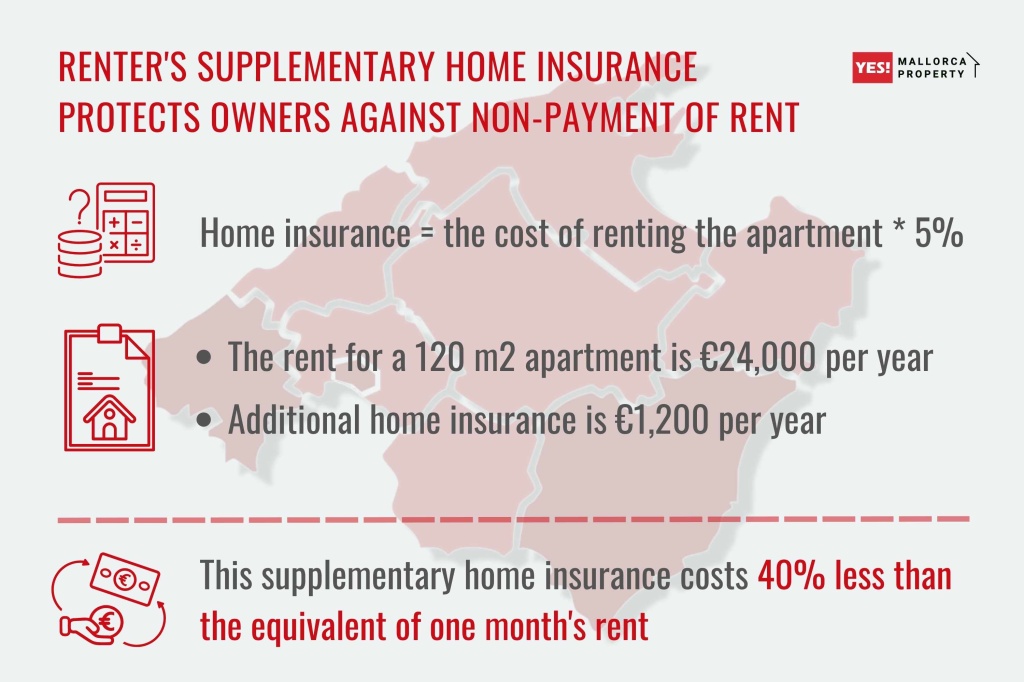

In addition to the above, additional home insurance for holiday rentals in Mallorca may be necessary. Renter's supplementary home insurance in Mallorca is property insurance that protects owners against non-payment of rent. Owners can receive payments from the insurance company if the tenant does not pay by taking out this type of insurance. This type of insurance benefits owners who rely on rental income to pay for their mortgage or other expenses.

Additional home insurance in Mallorca for rentals ranges from 4% to 6% of the annual rent.

Example:

Home insurance = the cost of renting the apartment * 5%

The rent for a 120 m2 apartment is €24,000 per year.

Additional home insurance against non-payment of rent would be: €24,000 * 5% = €1,200 per year. The cost of the insurance policy will therefore be 40% lower than the one month's rent.

In the case of a tenancy agreement, there are also two other types of insurance.

Landlord's insurance — additional insurance against vandalism by your tenant

Tenant insurance — Renter's liability insurance and the option of insuring your possessions (furniture, jewellery, etc.)

The cost of these types of insurance ranges from €50 to €55 per month.

Advice on Home Insurance from a Property Broker in Mallorca

Mallorca Property strongly recommends taking out additional home insurance in Mallorca in all cases, as long as it is affordable. Many property buyers only live on the island part-time, and having insurance provides peace of mind and protection for their property.

Insurance payments can be adjusted by selecting appropriate options, such as excluding household insurance to get cheaper premiums. However, this may result in a lower payout in the case of an insured event.

Insurance companies in the Balearic Islands offer many flexible programs that can be tailored to your personal needs. There are two main types of property insurance in Mallorca: multi-risk and all-risk insurance. Multi-risk insurance offers limited coverage for specific situations and accidents. In contrast, all-risk insurance covers a broader range of events, including those not explicitly stated in the contract but deemed insured. All-risk insurance is generally 15-20% more expensive than multi-risk insurance.

As property brokers, we advise our clients to carefully consider their options and choose the type of insurance that best suits their needs and budget.

|

Type of home insurance in Majorca |

Coverage area |

The average cost of insurance per year |

|---|---|---|

|

Against damage to your Home |

It extends to all knowledge and is legally compulsory if our house is mortgaged. This is the minimum cover for the mortgage cost in the event of a severe loss. |

From 50 euros |

|

Private house insurance in Majorca |

|

From 200 euros |

|

Second property insurance |

You can extend it with new coatings, such as damage due to acts of vandalism

|

From180 euro |

|

Insurance for the tenant or landlord

|

|

From 100 euros |

|

Combined property insurance |

Includes building insurance in Majorca and household contents insurance and also protects against:

|

Coverage and costs will vary depending on individual parameters and the insurance company. |

Ways to Lower the Cost of Property Insurance in Mallorca

There are several ways to reduce the cost of your property insurance in Mallorca. One of the most effective methods is customising your policy to suit your needs. By choosing only the required coverage, you can avoid paying for extra coverage you do not need.

Factors that increase the cost of property insurance:

-

The large size of the property

-

Type of property (more luxurious properties tend to have more expensive insurance)

-

Number of bedrooms and bathrooms

-

Average cost per square meter in the location (higher cost areas will have more expensive insurance)

-

Ground-floor apartments in a building

-

Extended or comprehensive coverage package

-

Location of the property in a room with high crime or low social status

Ways to make home insurance cheaper:

-

Availability of community insurance

-

Availability of an alarm system

-

24-hour security or video surveillance

-

Availability of non-electronic security systems

-

Limited insurance risks

-

Uncovered amount (deductible)

-

Paying for property insurance for the entire year at once

-

Recent year of construction for the building

-

Renovations to the premises, hydraulic systems, electrical systems, and gas systems

-

Proximity to fire and police stations.

Examples of the cost of home insurance in Mallorca

The cost of home insurance in Mallorca depends on the number of square metres, the type of Home and the options chosen to cover the benefits.There are legitimate questions when choosing home insurance:

-

Which home insurance is best?

-

How expensive is good home insurance?

-

How much does home insurance cost per year?

-

How much does cheap home insurance cost?

For example:

-

For a classic flat of up to 100 m2, the insurance cost will be between 200 and 300 euros per year. This type of home insurance in Mallorca covers a significant proportion of the property's value. It has limited benefits. And it applies in specific cases set out in the insurance contract.

-

A comprehensive all-risk insurance policy is most suitable for Mallorca's large estates and luxury villas. Such insurance costs an average of €3,000. Such insurance can often be more expensive. It all depends on the specific type of Mallorca accommodation you choose to insure.

Example of luxury apartments insurance options:

The apartment of 106 m2 was purchased in 2022

Year of construction — 1995

The flat is located on the top floor of the building

Apartment price — €850,000

The insurance company Allianz is one of the leading players in the property insurance market in Mallorca.

The insurance company provided five options with price gradations and risk coverage conditions.

|

Coverage |

Partial coverage |

Extended package |

Package Safe |

Package with enhanced security |

Full coverage |

|---|---|---|---|---|---|

|

Essential protection, civil liability and defence. Legal |

yes |

yes |

yes |

yes |

yes |

|

Housing and civil liability |

yes |

yes |

yes |

yes |

yes |

|

Breakdowns, electrical faults and chilled goods |

no |

yes |

no |

yes |

yes |

|

Extended protection and theft |

no |

no |

yes |

yes |

yes |

|

Protection of values |

no |

no |

no |

no |

yes |

|

Extending civic responsibility at Home |

no |

no |

no |

no |

yes |

|

White Line appliance repair |

yes |

yes |

yes |

yes |

no |

|

Additional Service |

yes |

yes |

yes |

yes |

yes |

|

The cost of the insurance policy per year |

272,92 |

310,34 |

288,27 |

325,69 |

389,61 |

Before buying home insurance in Mallorca, asking about available discounts is always a good idea. Some insurance companies offer discounts if you pay for the insurance for several years or if you are a client of a partner bank. For instance, the flat owners in our example received a 25% discount on the maximum value of their insurance by taking out insurance with their bank, a partner of the insurance company. The final cost of their insurance was €393.40 per year. Depending on your account balance, the bank may cover part of the insurance to increase customer loyalty.

Real Estate Insurance Companies in Mallorca

If you want home insurance in Mallorca, one of the most common options is to take it out with a bank. This type of insurance offers high security and often comes with reduced client fees. If you're looking for a cost-effective insurance solution for your Mallorca property, we recommend consulting the bank where you're a regular client.

Another popular way to purchase home insurance in Mallorca is through an insurance company. The island has various specialised companies offering relevant services at competitive prices.

|

Name and Web Site |

Country |

|---|---|

|

A Spanish insurance company |

|

|

Mallorcan Insurance Company |

|

|

A German insurance company |

|

|

A French insurance company |

|

|

A German insurance company |

How to Choose a Home Insurance Broker in Mallorca

If you are still getting familiar with the property insurance market in Mallorca but want to insure your Home cost-effectively, start by consulting your estate agent. An experienced real estate agent can recommend the best property insurance programs in Mallorca and has much experience dealing with insurance companies.

Another good approach is to contact the insurance companies that are market leaders in Mallorca and have a few consultations over the phone or in person. After talking to an insurance company that interests you, read honest customer reviews of the company.

Is Construction Insurance a Mandatory?

You must obtain property insurance for up to 10 years when building a house in Majorca. The ten-year coverage period begins as soon as the certificate of receipt of the house is issued.

You must pay for this insurance in two instalments: 30% when entering the contract and 70% after construction is completed. The insurer will issue a notarised insurance registration certificate at the Land Registry Office. The average cost of this insurance is 0.85% of the building's value.

This type of insurance covers risks for ten years after the completion of construction related to damage to the structure of the building or deformation due to ground movement. A ten-year insurance policy is required for any house sale to fulfil the specified operation.

Wrapping it Up

If you're looking for advice on home insurance in Mallorca, Yes! Mallorca has some tips to help you choose the right coverage:

-

Look for property insurance from reputable companies with a good track record.

-

Check with your bank to see what home insurance they offer through their partner companies.

-

Feel free to ask for a discount on your premium.

-

Consider opting for an insurance policy with a more comprehensive list of coverage. The price difference may be minimal, but it can give you greater peace of mind.

-

Installing a state-of-the-art security system can make your home insurance more cost-effective and reduce the risk of break-ins.

-

If you spend little time on the island but have an expensive property there, avoiding skimping on home insurance is essential.

-

While it's not a legal requirement, home insurance is crucial for your safety and to protect your property.

Contact your Mallorca estate agent for advice. They have a wealth of experience and can recommend the best places to insure your property.

Yes! Mallorca Property is a trusted real estate broker in Mallorca with a 5-star rating on Google. We can help you buy or sell a Mallorca property quickly, profitably, and reliably. We can advise you on where to save on home insurance in Mallorca and when to pay the entire premium. We always guide our clients on which insurance companies to approach and which brokers to avoid.

If you're interested in buying a Mallorca property, submit your request today, and one of our team members will contact you promptly.