Mallorca Mortgage Made Simple: Your Step-by-Step Guide to Homeownership

If you're considering buying a home in Mallorca in 2023 with a mortgage, it's important to understand the process and pay close attention to the details. Over the past five years, half of all property sales in Mallorca have involved a mortgage, and that number is expected to increase to over 60% by the end of 2022. This article explains all the details of buying a home in Mallorca in 2023 with a mortgage.

Content:

How often people buy a house on a mortgage in Mallorca?

What can you get a mortgage for?

Documents you need for applying for a Home Loan in Spain

Can I take out a mortgage to buy a house in Majorca from a bank in my country?

How much can I borrow for a mortgage?

Mortgage types and relevant rates

Refinancing and transferring mortgages to other banks

Selling a property with an existing mortgage

Important things to keep in mind when taking out a mortgage

Is it profitable to take out a mortgage in Mallorca today?

How often people buy a house on a mortgage in Mallorca?

Data provided by the Institut d'Estadística de les Illes Balears (Ibestat) and the Instituto Nacional de Estadística (INE).

What can you get a mortgage for?

Banks in Spain offer a wide range of mortgages for various purposes. There are loans for standard types of property, such as apartments, villas, country houses etc.

Most banks like Caixabank, Banco Santand, Banco Santander, Banco Sabadell lend up to 80% of the value of this type of property. It must be understood that the borrower must have savings of at least 20% of the property value before submitting the documents, and between 10% and 12% to pay the associated taxes and fees on the purchase.

It is also possible to take out a mortgage for construction or renovation. In this case, financing can be up to 100% of the actual construction cost and 70% of the price for renovation or repair.

It is essential to understand that when requesting 100% financing for the construction of a house, the land will not be included in the loan amount. One of the main conditions for obtaining such a loan is to provide a title deed when applying for the loan. These conditions can be found here.

It's worth noting that some banks provide combined programmes if you intend to purchase a plot to construct a house. For instance, Banco Santander offers a unique mortgage programme that caters to such requirements. This programme allows borrowers to obtain up to 60% of the appraised value of the land they intend to build on, thereby providing them with ample financing to construct their dream home.

Requirements to the borrower

Mortgage loans are accessible to both Spanish and Mallorcan locals and expatriates. Spanish citizens may be granted financing up to 80% of the property's value, while non-residents may be granted mortgages up to 70% of the property's assessed worth. Most banks provide comparable programs. In reality, some banks are more open-minded when evaluating applications from foreign nationals.

Mortgages are comparatively more straightforward for European nationals such as Germany, France, Holland, and Austria. This is due to their average income being notably higher than the average income in Spain.

Lending to Swiss and British citizens may have some nuances. This is because of Switzerland's unique tax system and the bank's risk of converting the loan's currency from Euros to Swiss Francs or British Pounds if requested by the borrower.

However, Yes! Mallorca Property has expertise in assisting Swiss and British borrowers. In 2022, the firm completed several prosperous mortgage transactions for citizens of these countries with Sabadel Bank's support.

Documents you need for applying for a Home Loan in Spain

1. Firstly, a passport or identification document from the borrower's country of origin is necessary. This document will contain most of the essential information about the borrower that the bank needs to assess their eligibility.

2. Secondly, the borrower must be within the appropriate age range to qualify for a mortgage loan. Most banks set the age limit for borrowers between 21 and 60 years old, though this may vary depending on the laws of the borrower's home country.

3. Thirdly, the borrower must provide proof of payment of personal income tax. This is crucial in demonstrating the borrower's income and expenditure, and for non-residents, the supporting document is the IRPF. Data for the last two years must be provided.

4. Finally, the borrower must provide evidence of their ability to repay the loan. Both residents and non-residents in Spain can confirm their income by providing a pay slip for the previous two months. The borrower must also provide a bank statement for the last three months to demonstrate monthly expenses. Additionally, a valid work contract must be submitted to prove income.

It is important to note that the borrower's monthly expenses must not exceed their income by more than 40%.

Can I take out a mortgage to buy a house in Majorca from a bank in my country?

Yes, residents of some European countries can request financing to purchase property in both Mallorca, Spain, and their own country. However, an essential requirement for obtaining such a mortgage is that the borrower must own property in their home country, which they can provide as collateral.

It is important to note that the terms and conditions of these loans are generally less favorable than those offered by Spanish banks. The interest rate is typically 1% higher, and the loan amount is 10%-15% lower. Banks bear higher risks when financing the purchase of property in a foreign country.

The procedure for obtaining a mortgage

The procedure for obtaining a mortgage from banks in Spain is the same in all autonomies, including Mallorca. It includes 7 steps as follows.

Providing a NIE (tax identification number). If you do not have one, you must obtain it. The procedure for getting NIE is easy but requires some knowledge. Usually, real estate agents in Mallorca will accompany the process if necessary.

1. Opening an account in a Spanish bank.

2. Preparing and sending the bank documents for a mortgage loan.

3. Obtaining a preliminary decision from the bank. In Mallorca this procedure takes 2 to 5 working days.

4. Appraisal of the property (in case of a favourable decision to grant a mortgage). In Spain, banks are not allowed to carry out their valuations of mortgages. Valuations can only be carried out by valuation companies certified by the National Bank of Spain (Banco de España).

5. After the final appraisal of the property, the borrower transfers part of their funds to the notary's account.

6. Signing a mortgage agreement with a notary. Registration of the purchase and sale of real estate. Registration of the transaction in the State Register of Real Estate.

IMPORTANT: The maximum loan amount calculation will be based on the lowest possible amount - sale price or appraised value.

The list of documents for Mortgage Loan Application

-

IRPF Declaration 17 Y 18)

-

Existence of outstanding mortgages

-

DNI number, NIE number

-

Passport

-

Bank statement for 3 months

-

Mortgage borrower questionnaire by bank form

-

Employment contract

-

Payroll for the last 2 months

-

For German citizens - Schufa Auskunft : certificate of Germany

How much can I borrow for a mortgage?

|

Status |

Maximum % of financing from the value of the property |

Maximum amount to calculate a mortgage on Spanish bank websites |

Minimum age |

Maximum age |

The ratio of the maximum cumulative expenditure payment to income |

Down payment of own funds |

Taxes and fees as a % of property value |

|---|---|---|---|---|---|---|---|

|

Resident |

80% |

up to EUR 1,500,000 on the bank's website. Individually in personal consultation |

21 years |

60 years |

40% |

20% |

15% |

|

Non-resident |

70% |

1,500,000 EUR on the bank's website. Individually in personal consultation |

23 years |

60 years |

40% |

30% |

15% |

In Mallorca, the value of properties is often higher than on the mainland due to the island's luxury status, which is the main difference between mortgage lending in Mallorca and the rest of Spain. The maximum loan amount is capped at EUR 5,000,000, and mortgages for larger amounts are determined on a case-by-case basis and depend on the borrower's proven income.

The mortgage payment with fixed costs must not exceed 40% of the borrower's verified income. Spanish residents can borrow up to 80% of the property's appraised value, while non-residents can borrow up to 70%. During the COVID-19 pandemic, banks underestimated property values, with the maximum being 50%-60%. However, from December 2021, banks have been more willing to grant mortgages up to 70% of the appraised value of the property.

The situation regarding mortgage approvals changed multiple times during 2022 due to the imbalance in the global economy, causing Spanish and European banks to revise their policies repeatedly. By the end of the year, the fluctuations had somewhat calmed down, with the maximum mortgage amounts remaining at 50% to 80% of the property's value.

Non-resident buyers of a property in Mallorca must pay at least 30% of the property value from their funds. Additionally, they must pay taxes and levies amounting to 10%-12% of the property's value related to the purchase of the property.

Buyers from European countries sometimes take out a consumer cash loan on favorable terms in their home country to repay part of their funds not financed by Spanish banks when obtaining a mortgage.

Mortgage types and relevant rates

In Mallorca, as elsewhere in Spain, banks offer three mortgage loan types to individuals - Fixed, Variable and Mixed rate.

Fixed rate. A mortgage with a fixed rate for the duration of the loan. Has a type of annuity payment. Calculated when the mortgage is taken out and remains constant. Suitable for those who care about payment stability. No economic change affects the interest on this type of mortgage and the repayments. The initial rate will be slightly higher than other types of mortgages.

Variable rate. A mortgage option with increased risk for the borrower. The interest rate will be much lower when the loan is issued. But, in subsequent periods, the rate can go down and up. Every 6 months banks recalculate the rate to reflect changes in the market. The index used to adjust the interest rate in Spain is called Euribor. This type of mortgage is suitable for borrowers with high income and those planning to close the mortgage early, much earlier.

Due to global turmoil in 2022, Euribor increased, resulting in a significant rise in mortgage rates. As a consequence, many borrowers had to bear the burden and pay higher mortgage installments, which could go up to 50%. Although this format may prove profitable in the long run, it may not be as favorable for those who have recently taken out a mortgage.

Mixed rate. This is a mix of the first two types of mortgages. The first part of the term is based on a fixed rate. Euribor index system is applied to the remaining period. At a fixed rate for the first third of the loan term. But this term can be changed individually to suit the wishes of the borrower a mortgage in Mallorca. It also has a risk for the borrower. But as a rule, such a mortgage is closed before the deadline. Mixed-rate mortgages are suitable for those who foresee an increase in their income in the foreseeable future.

Mortgage rates in Mallorca

Mallorca has a wide range of banks with affordable mortgages. Sabadel, La Caja bank, Santander, BankInter, BBVA, Bankia are the most popular.

The basic terms and conditions are similar. But the benefit to the borrower may be different. The realtor and the real estate agency supervising the deal will introduce the best offers to their clients.

Spanish bank mortgage rates for April 2023

The adjustment factor will be the floating Euríbor rate. At the end of March 2023, Euríbor was 3.65%. Bankinter and FUNCAS forecast that the Euribor rate will float at 3% and 3.37% at the end of 2024.

The following factors may also affect the mortgage rate:

-

credit reduction

-

home insurance

-

life insurance

-

contributions to the pension fund

-

wage transfer to an account

Mortgage processing costs

The civil court ruled that after 2019, most of the additional costs associated with obtaining a mortgage must be borne by the bank that provides the financing.

-

As of March 2022, the borrower incurs the following costs when taking out a loan

-

Mortgage origination fee - from 0.5% to 1% of the requested loan amount

-

Bank valuation of the property up to 0.1% of the value of the home

The cost of property insurance. The cost of this insurance will vary depending on the timing of the contract, the characteristics of the mortgaged property, the capital insured, and the contractual guarantees. The average for banks is 0.25% of the property's value per year.

Borrower's life insurance. Payable quarterly at an approximate cost of EUR 90.

Under current Spanish law, the bank cannot force property insurance to be included in the cost of the loan. The client can choose the insurance company with the most favourable conditions. But in practice, taking out insurance in the same bank where the mortgage is taken out affects the final terms in the contract for the buyer of real estate in Mallorca. The bank can reduce the rate from 2.6% to 1.59%.

Early repayment

A mortgage loan can be repaid early at any stage. But depending on the bank, there will be a moratorium on early repayment for 3 to 5 years. In the event of early mortgage repayment during the moratorium period, the owner must pay an amount determined individually by each bank.

Refinancing and transferring mortgages to other banks

Banks in Spain have many mortgage refinancing programmes within the bank and the possibility of moving a mortgage from another bank.

The changes can be seen as:

Increasing the loan amount

Increasing or decreasing the term of the loan

Obtaining additional funding. For example, for repairs or construction

Changing from fixed to a variable rate and vice versa

As a rule, the bank charges a fee of between 0.1% and 1% of the amount requested.

Selling a property with an existing mortgage

Suppose a property owner in Mallorca decides to sell his property being pledged to a bank. In that case, he must carry out a few additional steps:

-

You must notify the bank of your intention to sell the property. This can be done by e-mail to the bank branch where the mortgage was issued. This is best done as soon as the buyer signs the option agreement.

-

Obtain a certificate from your bank showing the balance owed.

-

Provide the certificate to the purchaser to write a cheque to the bank.

Notify the bank of the date and time of signing the transaction at the notary. This ensures the bank representative is present at the notary when the sale agreement is signed. The bank officer receives his cheque and marks the Escritura de cancelación de hipoteca - Mortgage Cancellation Document.

The last step is mandatory. The mortgage must be cancelled at the property registry. If this is not done, the property will remain in mortgage status even after sale. You can do this by paying the fee yourself. The amount of the fee varies and ranges from 200 euros to 350 euros. Or you can use the services of a lawyer.

Important things to keep in mind when taking out a mortgage

To receive mortgage guidance, scheduling an appointment with a bank representative is necessary. A complete set of documents must be presented in person at the bank, and a list of required documents is sent via email in advance.

While it is possible to obtain remote information about funding, it is solely for consultation purposes.

Mortgage rates in the Balearic Islands remain consistently low (1.98 - 2.67%) as of March 2022 due to the autonomous government's policy to enhance investment attraction.

Mallorca's banks are willing to negotiate terms and are happy to provide mortgages. One out of every two real estate transactions in Mallorca involves a mortgage. Additionally, the number of positive mortgage decisions in Mallorca exceeds the mainland Spain average by 20%.

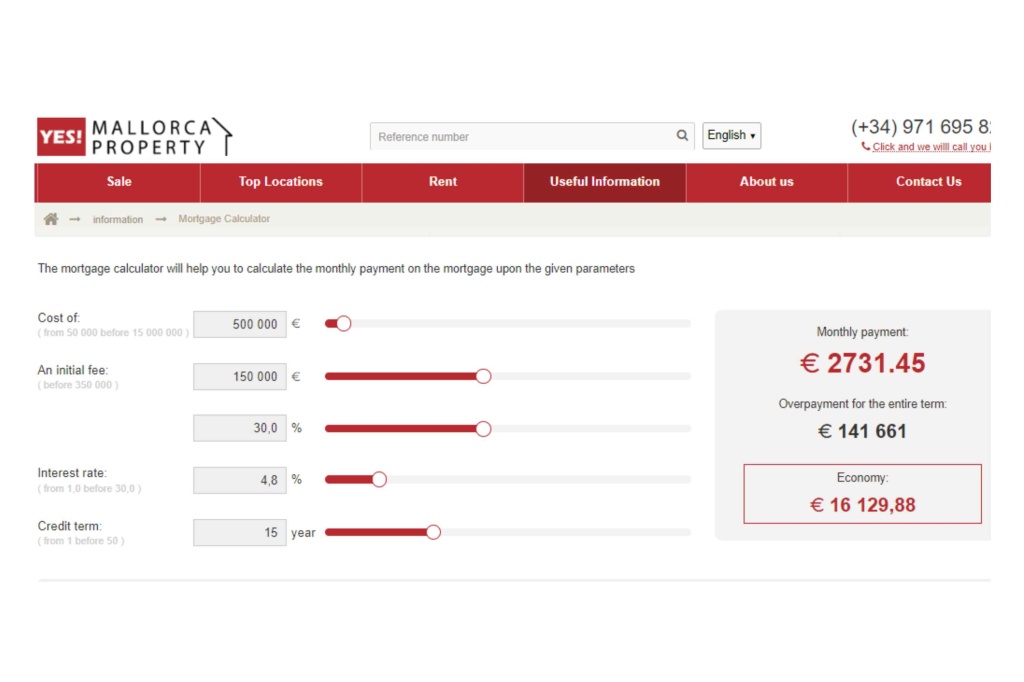

Mortgage calculation examples

Apartments in Mallorca for €500,000 on the secondary market.

Loan term 15 years

Fixed rate 4.8%

Downpayment— 30%

Monthly payment €4,102.37

Overpayment for the entire term €100,926

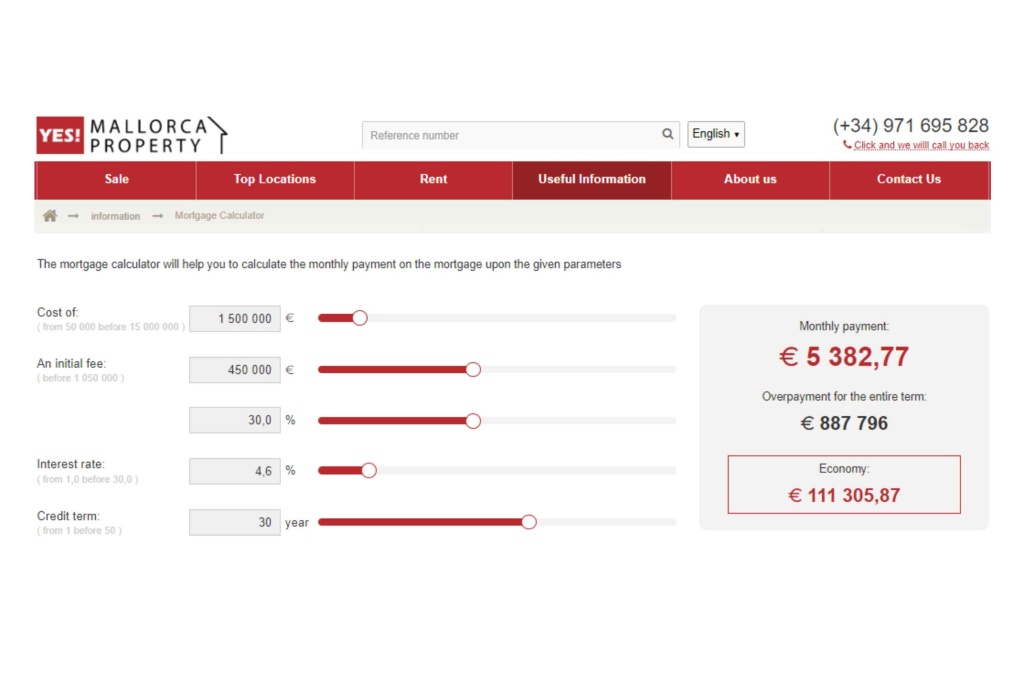

Villa in Mallorca for €1,500,000.

Contribution of own funds 450,000 euros

Loan amount €1,050,000

Loan term 30 years

Reduced rate 4.6%

Monthly payment - € 5,382.77

Overpayments - € 887,796

Are you interested in specifying your personal parameters? Utilize the mortgage calculator.

Is it profitable to take out a mortgage in Mallorca today?

The rejection rate for foreign nationals in Mallorca in 2022 is minimal. Half of all real estate transactions on the island involve mortgages. In practice, the real estate agency Yes! Mallorca Property purchase of housing with the borrowed funds from the bank exceeds 50%. On the 10 signed contracts of sale in the agency, there are at least 6 contracts with mortgages.

|

The average mortgage rate in Mallorca is |

4,1% |

|

Mallorca property price growth forecast for 2023 -2024 |

+10% to +32% |

|

Average annual price increase in Mallorca (2018 - 2023) |

+8% to +16% per year |

|

Increase in property values in Mallorca over the last 15 years according to UltimaHora |

+ 35% |

|

Changes in the average annual rental rate in Mallorca |

+6% |

By acquiring a property in Mallorca with a mortgage, the homeowner can obtain an asset that fully covers their expenses and generates considerable profit. If you are considering purchasing property in Mallorca with the help of a mortgage, YES! Mallorca Property's team is at your service. We have a proven track record of successful mortgage lending cases and established partnerships with banks that offer our clients more favourable financing terms.

Don't hesitate to contact us today and let us assist you!

Helpful links for property buyers

2. Property Listing in Mallorca